While cities and counties across the country face municipal bankruptcy and other financial crises, Knox County’s financial outlook is strong and continues to improve, according to the nation’s two leading credit rating agencies. A strong bond rating is an important indicator for potential lenders of a government’s financial well-being. Knox County’s strong credit ratings help keep the cost of borrowing money relatively low.

Both Moody’s and Standard & Poor’s have affirmed Knox County’s strong bond ratings of Aa1 and AA+, respectively. Citing Knox County’s “historical maintenance of strong finances,” S&P went a step further by upgrading Knox County’s financial outlook from stable to positive. This indicates that Knox County is approaching a AAA rating.

Moody’s, in affirming Knox County’s Aa1 rating and stable outlook, cited the County’s strong financial position and reserves, improved liquidity, sizable revenue base and manageable debt burden as factors in their rating decision.

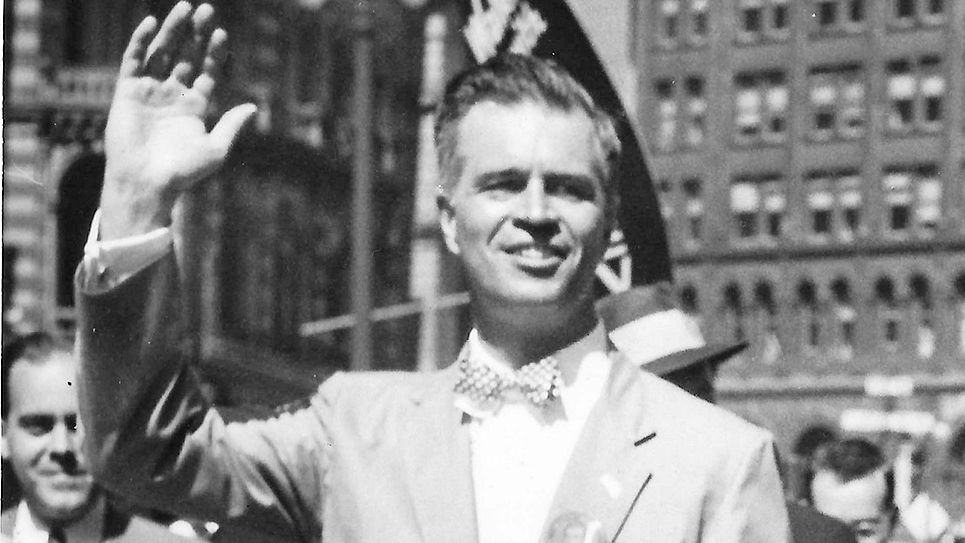

“As cities like Detroit are filing for bankruptcy, and Washington politicians are refusing to deal with the federal government’s financial issues, Knox County is operating in a conservative, fiscally responsible manner,” said Knox County Mayor Tim Burchett. “This news from our ratings agencies is proof that we’re doing the right things: paying down debt, addressing our pension liabilities, maintaining strong reserves and controlling government spending – all while continuing to provide great service to Knox County citizens.

“Bond ratings aren’t something only accountants look at,” said Knoxville Chamber President and CEO Mike Edwards. “A strong bond rating sends a message to existing and prospective businesses that Knox County isn’t going to have to increase their taxes to make up for poor fiscal management.”

“Knox County’s strong bond ratings and improved outlook show that our prudent fiscal management is paying off,” said Knox County Finance Director Chris Caldwell. “Paying down debt and funding operations with natural revenue growth have served us well, and that means Knox County can access the credit markets efficiently and effectively to provide for the community’s needs.”

S&P and Moody’s evaluate and rate the financial management of Knox County and many other governments, including state and federal, each year.