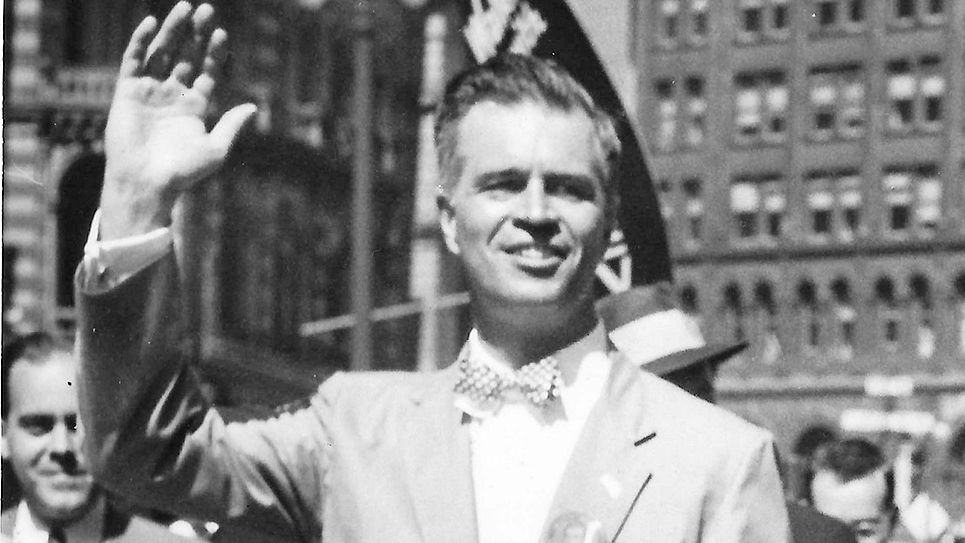

State Senator Richard Briggs (R-Knoxville) is encouraging citizens to take advantage of Tennessee’s 15th annual Sales Tax Holiday set to begin the last weekend in July. This year, the General Assembly passed legislation extending the yearly tax-free weekend to two weekends and doubling the price limits on most tax-exempt items. This extension, which was supported by Sen. Briggs in the 2020/2021 state budget, will help Tennesseans save money and support the economy for retail businesses and restaurants.

“The Sales Tax Holiday is more significant than ever before for families, citizens and businesses,” said Senator Briggs. “As the economy continues to suffer from the COVID-19 pandemic, it is important for citizens to be able to keep more money in their pockets while also boosting spending at local businesses and restaurants. I encourage all citizens to take advantage of these tax-free weekends.”

Senator Briggs also stressed the importance of continuing responsible behavior as citizens participate in the tax-free weekends.

“I also want to remind citizens that when visiting local retail stores and restaurants, it remains very important to wear a mask and keep your distance from other people whenever possible,” added Briggs. “And if you are not feeling well, shop online. Eligible items purchased online will also be tax-free. It is imperative to practice these responsible behaviors, if we want to continue to see the economy improve.”

The first tax-free weekend focuses on clothing and other back-to-school items. It begins at 12:01 a.m. on Friday, July 31, and ends Sunday, August 2, at 11:59 p.m. During this time, consumers may purchase clothing, school supplies, and computers and other qualifying electronic devices without paying sales tax. Certain price restrictions apply. For school supplies and clothing, the threshold for qualifying items is $200 or less. For computers and other electronics, the price threshold is $3,000 or less. Download the full list of tax-exempt items here.

Exempt items sold online are also eligible. Consumers must purchase items for personal use, not business or trade.

The second sales tax holiday weekend focuses on restaurant sales. It begins at 12:01 a.m. on August 7 and ends Sunday, August 9, at 11:59 p.m. During this time the retail sale of food and drink by restaurants and limited service restaurants, as defined in Tenn. Code Ann. § 57-4-102, is exempt from sales tax.

For more information about the sales tax holiday weekends, visit www.tntaxholiday.com.