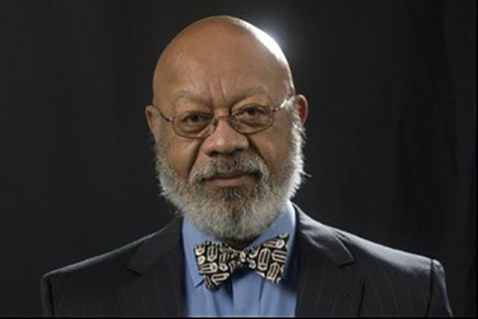

By Dr. Harold A. Black

As a young assistant professor, I was the faculty advisor to the student libertarian party at the University of Florida. We sold bumper stickers that said, “Taxation is Theft.” Mine was stolen.

America has the most progressive income tax structure in the world. Biden and the “progressives” (socialists) in Congress have called for the rich to pay their “fair share.” Yet these leftists to my knowledge have not defined “fair share.” The hue and cry were motivated by the ProPublica article showing that 25 billionaires were paying little if any Federal income taxes while their wealth was increasing by billions. The reason is that there is a difference between wealth and income. Most of the billionaires have their wealth in stocks and investments – often in their own company. Elon Musk’s wealth is in Tesla stock, Jeff Bezos’ wealth is in Amazon. Bill Gates’ and Paul Allen’s wealth is in Microsoft. If the price of their stock increases, their wealth increases, but not their income. Many take little or no income at all. Instead, they can sell some of their investment holdings which will be subject to capital gains tax. The ProPublica piece did not detail how much the rich were paying in realized capital gains. The increases in wealth from unsold investments is called unrealized capital gains. If the investments are held for more than one year, the gains are taxed at a rate of 20% for the highest brackets – well below the 37% top rate for ordinary income. Of course, investments can lose value. Indeed, George Soros, who gives millions every year to leftist causes, reported that he did not pay income tax because of investment losses. The Biden Administration is supporting a billionaires’ tax where unrealized capital gains would be taxed as ordinary income. Aside from the negative impact this would have on investments, think of the blowback in the case of losses where the IRS would have to write a tax refund check to billionaires like Musk and Soros.

Those on the left keep saying that people must pay their “fair share”. These are buzz words for “increase their taxes”! So what is one’s “fair share?” Consider that the highest-earning 1 percent of Americans pay 40.1 percent of all Federal income taxes. The top 50 percent pay 97.1 percent. Also usually around 42 percent of Americans pay no Federal income taxes at all. An impact of COVID in 2020 resulted in 61% of American households paying no federal income tax. Is this “fair” for those of us who pay the taxes?

With the heaviest burden falling mainly on high earners, the only group not paying their “fair share” are those who are not paying any federal income taxes at all. This lower income group does not have any skin in the game. Campaigns to lower taxes do not find empathy with those who pay no taxes. It seems to me that a minimum requirement of residency in this country should be the paying of federal income taxes by everyone regardless of income. This is why I am for a flat tax. A flat tax of 18 percent would provide the government with “revenues” sufficient to cover its expenditures – except with the current administration. I just can hear the wailing about it being “unfair” to tax those with the lowest incomes. But is it? Low-income people receive subsidies through transfers like food stamps, housing subsidies and numerous welfare programs. Although their income will now be taxed, the poor will likely get a net gain from the in-kind payments. Lastly, a flat tax is simple and elegant. If enacted, value-added taxes should be prohibited and all realized earnings regardless of source should be counted as income. By the way, a flat tax is preferable to the so-called “fair” tax which is a consumption tax. A consumption tax is hidden. This is bad because it is important for all to know exactly how much of their income goes to the government. A flat tax accomplishes this while the “fair” tax does not. So in order for people to pay their “fair share,” everyone, including the poor, should pay.